Table of Contents

Introductions

The Iran-Israel conflict is one of the deadliest conflicts, not because it is harmful to mankind, but because it is detrimental to the world economy. In this blog, we’ll analyse the consequences that affect the Indian economy and the Indian stock market. As we all know, wars never come with great results. Every war affects the economy, especially if your economy is dependent upon crude oil. Because war affects its price, and if the price of crude oil increases, then the cost of living in a country like India is also affected.

Increased oil prices result in an increase in the cost of transportation, which affects the balance sheets of the companies, and household goods become expensive. However, both of these countries are thousands of kilometres away from India, but the consequences of a war never respect boundaries.

Iran-Israel conflict Fallout: Why the World Is Paying More for Oil

Have you ever noticed why the world, especially in countries like India, pays more for oil during times of war? One of the main reasons that caused the sudden price hike is the Iran-Israel conflict. This sudden spike in oil prices is largely due to the strategic location of Iran, which sits at the edge of the Strait of Hormuz. The Strait of Hormuz, a narrow but vital waterway that handles over 20% global oil supply. On an everyday basis, this handles approximately 17-18 million oil barrels. When the tensions rise in this region, the risk of supply disruptions dramatically increases which leads to a sudden price hike in the International oil markets.

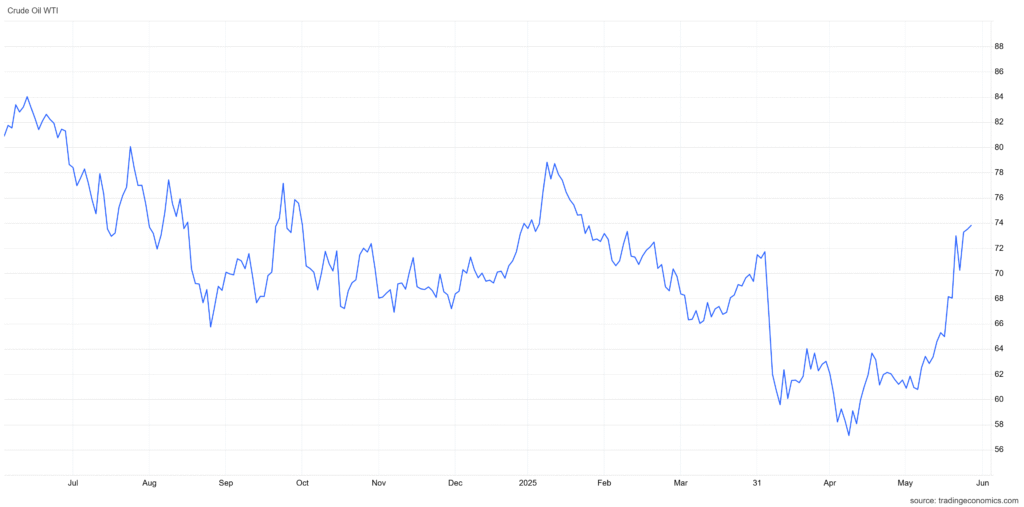

Crude Oil Price Trends Amid Iran-Israel Conflict (WTI – Last 12 Months)

Crude Oil: The most affected commodity due to the Iran-Israel conflict.

Crude oil is the lifeblood of global industries. Especially Indian Industries, because with the rise of crude oil prices, industries need to compromise with their profits due to a sudden increase in transportation costs, which directly affects the livelihood of Indian citizens. Crude oil is the main source of energy for transportation, industrial production, and it also serves as a raw material in the making of countless products such as fertilisers, plastic goods and pharmaceuticals.

In developing countries like India, crude oil plays a crucial role in determining inflation, trade balance, and overall economic health. A rise in crude oil can directly affect fuel cost, logistic expenses, which exacerbate the sudden rise in manufacturing cost, and it also affects the stock market.

With the sudden rise in crude oil prices, the depreciation of the Indian Rupee happened because almost 90% of crude oil is traded in U.S. dollars, which results in strengthening the U.S. dollar position compared with the Indian Rupee. Depreciation of the rupee value affects the direct trade. It affects our foreign reserves because we have to pay more dollars to buy high-priced crude oil, and it also makes an impact on foreign investors. Always remember, an investor always wants to be invest in a stable country with high dollars reserve because it gave stability to the economy.

Why crude oil matters for India

- A surge in oil prices (say $100–120/barrel) would dramatically increase India’s import bill.

- This would widen the current account deficit (CAD) and put pressure on the Indian rupee.

- India imports 80%+ of its crude oil needs.

Impact of the Iran-Israel conflict on the Indian stock market with time line

The Iran-Israel conflict affects almost every stock market, especially the Indian stock market. Due to the Iran-Israel conflict, the foreign investors lost their trust in the Indian market which resulting in a massive sell-off. Due to which the stock market respects the trends, it starts correcting itself. Which spread a negative sentiment among domestic investors.

Increased Volatility:

- Risk-off sentiment may cause FII (foreign institutional investors) to pull out funds from emerging markets like India.

- Investors hate uncertainty. A war in West Asia would spike volatility in Indian indices like the Nifty 50 and Sensex.

Oil Prices Spike → Market Falls:

- Iran and Israel are in a region critical to global oil supply.

- Any disruption, especially in the Strait of Hormuz, could push crude oil prices above $100/barrel.

- Indian markets, heavily dependent on oil imports, would react negatively.

Sectors Most Affected:

- Oil & Gas: Refining companies may suffer due to higher input costs.

- Aviation: Higher jet fuel prices would hurt airline stocks.

- Logistics/Shipping: Increased shipping costs and insurance premiums.

- IT & Pharma: Relatively defensive, might outperform due to global risk-off trade.

The Indian market reaction timeline after the Iran-Israel conflict.

| Date | Key Event / Trigger | Market Movement |

| 13 Jun | Israeli strike on Iran → crude oil ↑10% | Nifty −1.2% to 24,587; Sensex −1.2% to 80,710 |

| 14 Jun | Geopolitical tensions deepen → panic selling | Sensex −823 points (~−1.0%) |

| 15 Jun | Cautious trade continues | Nifty & Sensex down ~200 points |

| 16 Jun | Rupee weakens; crude prices still elevated | Small-caps −2%, Mid-caps −1.6% |

| 17 Jun | Volatility persists; no clear rebound | Nifty ~24,793; Sensex ~81,361 |

Impact of the Iran-Israel conflict on the Indian economy:

1. Higher Inflation:

A rise in crude oil prices directly drives up fuel and transportation costs, which then filters through to almost every other sector—raising prices across the board. This could push retail inflation (measured by the Consumer Price Index) well above the Reserve Bank of India’s comfort level of around 4%.

2. Worsening Trade Deficit:

India relies heavily on imported oil, with over 80% of its crude requirements sourced from abroad. When prices rise, the country ends up spending much more on imports, widening the current account deficit (CAD) and straining the balance of payments.

3. Pressure on the Rupee:

As oil import bills grow, demand for the US dollar increases, putting downward pressure on the rupee. Foreign institutional investors (FIIs) pulling money out of Indian markets can add to this pressure, leading to further rupee depreciation and a rise in imported inflation.

4. RBI’s Dilemma:

In such a scenario, the Reserve Bank of India may be forced to delay any interest rate cuts—or even consider raising rates—to keep inflation under control. While this might help tame prices, it could also dampen credit growth and discourage private investment.

5. Slower Economic Growth:

With borrowing costs rising and inflation pinching household budgets, both consumption and investment are likely to slow. In addition, export-driven sectors like textiles and gems could take a hit if global demand weakens amid geopolitical uncertainty.

Sectors to Watch Amid the Iran–Israel Conflict

As tensions escalate in the Middle East, especially involving Iran and Israel, crude oil prices and overall geopolitical risk are climbing. This has ripple effects across the Indian economy and stock markets. Here’s a closer look at the sectors likely to be impacted the most:

🛢️ 1. Oil & Gas

- What’s Happening: Rising tensions are threatening oil supplies, especially through the vital Strait of Hormuz, pushing up crude prices.

- Who Benefits & Who Loses: Upstream oil companies like ONGC and Reliance could benefit from higher prices. On the flip side, sectors that rely heavily on oil—like transportation—may feel the pinch.

- Key Stocks: ONGC, Reliance Industries, IOC, BPCL

🏦 2. Banking & Financial Services

- What’s Happening: Market uncertainty tends to shake investor confidence, prompting foreign investors to pull money out of emerging markets.

- Impact: Banks could face short-term pressure due to rising credit risk and reduced foreign fund inflows.

- Key Stocks: HDFC Bank, SBI, ICICI Bank, Kotak Mahindra Bank

🚗 3. Auto Sector

- What’s Happening: Crude oil isn’t just fuel—it’s also used in making plastics, tires, and more. Higher oil prices mean higher costs across the board.

- Impact: Input costs rise, consumer sentiment weakens, and demand may slow down.

- Key Stocks: Maruti Suzuki, Tata Motors, Hero MotoCorp

🏭 4. FMCG (Fast-Moving Consumer Goods)

- What’s Happening: Fuel price hikes make transportation and packaging more expensive.

- Impact: Companies may see their margins squeezed, especially if they can’t pass on costs to consumers.

- Key Stocks: Hindustan Unilever, ITC, Nestlé India

🖥️ 5. IT & Tech

- What’s Happening: Uncertainty in the global economy could slow demand from key markets like the US.

- Impact: A weaker rupee may help earnings in the short term, but companies may turn cautious with future guidance.

- Key Stocks: Infosys, TCS, HCL Tech

🏗️ 6. Infrastructure & Capital Goods

- What’s Happening: High commodity prices and global instability could delay large-scale projects, especially those with international exposure.

- Impact: Mixed performance expected—some companies may benefit domestically, others could face delays or cost overruns.

- Key Stocks: L&T, Adani Ports, Siemens

✈️ 7. Aviation & Travel

- What’s Happening: Jet fuel is one of the biggest cost heads for airlines, and crude spikes can really hurt.

- Impact: Airlines may hike fares, but that could dent travel demand—making this one of the most vulnerable sectors.

- Key Stocks: IndiGo, SpiceJet, IRCTC

📊 A Sector-by-Sector Look at How the Iran–Israel Conflict Is Shaping Markets

The ongoing conflict between Iran and Israel has sent shockwaves across global markets, and India isn’t immune. From rising crude oil prices to shifting investor sentiment, nearly every major sector is feeling the heat. Here’s a deep dive into how the tensions are playing out in different corners of the economy—and what investors should keep in mind.

🛢️ 1. Oil & Gas

Tensions in the Middle East have pushed crude oil prices higher, largely due to concerns about disruptions near the Strait of Hormuz—a key route for over 20% of the world’s oil. Iran’s strategic position near this chokepoint adds to the risk.

🔍 What This Means:

- Winners: Upstream companies like ONGC and Oil India could benefit from higher crude prices.

- Losers: Downstream firms such as BPCL and HPCL may struggle with rising input costs, squeezing margins.

- India’s Vulnerability: With around 85% of its oil needs met through imports, India is especially exposed to oil price shocks.

💡 Investment Insight:

In uncertain times like these, investors often lean toward upstream oil explorers and stay cautious on refiners and fuel retailers.

🏦 2. Banking & Financial Services

The banking sector tends to mirror overall investor sentiment. With global uncertainty rising, there’s a clear risk-off mood, especially among foreign institutional investors (FIIs), who often pull funds from emerging markets first.

🔍 What This Means:

- Increased market volatility could weigh on financial stocks.

- FII withdrawals may lead to weaker performance for banks and NBFCs.

- A falling rupee increases the cost of borrowing from overseas.

💡 Investment Insight:

Banks with a strong domestic focus and minimal foreign exposure are better positioned to weather global headwinds.

🚗 3. Auto

The auto industry is especially sensitive to fuel costs—and with crude prices climbing, this sector could feel an immediate pinch.

🔍 What This Means:

- Rising fuel prices may hit demand for two-wheelers and entry-level cars.

- Input costs for materials like rubber, plastics, and metals are on the rise.

- Supply chains and logistics become more expensive, impacting profitability.

💡 Investment Insight:

Investors might shift focus to automakers with robust EV lineups or efficient cost structures that rely less on fossil fuels.

🏭 4. FMCG

Fast-moving consumer goods companies operate on thin margins and broad distribution networks—both of which are vulnerable to inflation and transportation costs.

🔍 What This Means:

- Higher crude prices drive up packaging and shipping expenses.

- Companies may struggle to pass on the increased costs to consumers.

- Rural demand, already under pressure, could weaken further.

💡 Investment Insight:

Market leaders with scale, brand power, and pricing flexibility—like HUL or Nestlé India—are likely to manage the turbulence better than smaller players.

🖥️ 5. IT & Tech

The IT sector isn’t directly exposed to the conflict, but the global macro environment it relies on could become less stable.

🔍 What This Means:

- A weaker rupee is good news for export-heavy IT firms.

- But clients in the US and Europe may delay projects or cut budgets amid rising uncertainty.

- Tech spending could slow if the conflict escalates further.

💡 Investment Insight:

Top-tier companies with a diverse global client base may offer relative stability. Mid-sized firms could see more volatility.

🏗️ 6. Infrastructure & Capital Goods

Infrastructure companies often deal with long-term projects that are capital-intensive and sensitive to commodity prices and funding conditions.

🔍 What This Means:

- Global uncertainty is pushing up prices for steel, copper, and cement.

- Projects involving international partners, especially in the Middle East, may be delayed.

- Global investors could hold back on funding new infrastructure projects.

💡 Investment Insight:

Firms with a strong domestic order book—especially those involved in government-backed infrastructure—are likely to fare better than those with high international exposure.

✈️ 7. Aviation & Travel

Of all sectors, aviation feels the immediate hit from rising oil prices. Jet fuel is one of the largest cost components for airlines.

🔍 What This Means:

- A spike in jet fuel prices significantly impacts margins.

- Airlines may be forced to raise fares, which can hurt demand.

- Broader travel and tourism sentiment weakens in times of geopolitical instability.

💡 Investment Insight:

This is typically a sector investors avoid during oil crises. Airlines with fuel hedging or a strong premium travel segment may handle the pressure slightly better.

📊 Sectoral Impact Summary (Macro Volatility Context)

| Sector | Impact Level | Key Risk Factors | Strategic Takeaway |

|---|---|---|---|

| Oil & Gas | 🔴 High | Crude surge → upstream gains, downstream squeeze | Prefer upstream players (explorers, producers) |

| Banking & Finance | 🟠 Moderate | FII outflows, currency volatility | Underweight global-exposed banks; prefer retail-focused |

| Auto | 🔴 High | Fuel/input inflation → demand pressure | Shift to EV-oriented firms |

| FMCG | 🟠 Moderate | Cost pressures via inflation & logistics | Stick with brands with pricing power |

| IT & Tech | 🟡 Low-Moderate | Rupee depreciation benefit; foreign demand uncertain | Favor diversified and domestic-focused IT |

| Infra & Capital Goods | 🟠 Moderate | Rising material costs, funding pressure | Prefer domestic infra with secured funding |

| Aviation & Travel | 🔴 Very High | Fuel cost spike, travel demand dampened | Avoid unless fuel-hedged or premium segment |

🔍 Overall Strategy

- Risk-On Sectors: IT (selectively), FMCG (with strong brand moat)

- Risk-Averse Approach: Avoid high-exposure plays like Aviation and Auto without clear mitigation

- Watchlist: Oil & Gas (split strategy), Infra (project-level scrutiny)

“Here’s the download link to my PDF report, where you’ll find a detailed analysis of India’s oil and gas sector.”

✅ Conclusion

The Iran–Israel conflict, while geographically distant, has had a very real and immediate impact on global energy markets—and India is feeling the heat. As a country heavily dependent on crude oil imports, the ripple effects show up in everything from fuel prices and inflation to stock market volatility and foreign investor sentiment.

While sectors like Oil & Gas, Aviation, and Auto bear the brunt of rising costs, others like IT and FMCG may offer pockets of relative stability. In uncertain times like these, awareness and adaptability become key for investors and policymakers alike.

Geopolitical tensions may be beyond our control, but understanding their economic consequences can help us prepare smarter, invest wiser, and navigate volatility with a clear head.

Disclaimer:

We are not SEBI-registered advisors. The information provided in this report is for educational and informational purposes only and should not be considered financial or investment advice. Please conduct your research or consult with a certified financial advisor before making any investment decisions. We are not responsible for any financial losses or portfolio impacts resulting from the use of this content.

If you found this article helpful, don’t forget to share it and follow InvestWithRonak for more insightful stock market content.